UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a partyParty other than the Registrant ☐

Check the appropriate box:

Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Conagra Brands, Inc.

(Name of Registrant as Specified In Itsin its Charter)

[NOT APPLICABLE]

(Name of Person(s) Filing Proxy Statement, if other thanOther Than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

| ☒ | No fee required |

|

|

|

|

|

|

| ☐ | Fee paid previously with preliminary materials. |

| ☐ |

|

|

|

|

|

| Conagra Brands, Inc. | |

| 222 W. Merchandise Mart Plaza | ||

| Suite 1300 | ||

| Chicago, Illinois 60654 | ||

August 6, 202110, 2022

Dear Shareholders,

I am pleased to invite you to join us for the Conagra Brands Annual Meeting of Shareholders, or the Annual Meeting, which will be held virtually via live webcast on Wednesday, September 15, 2021,21, 2022, at 2:00 p.m.11 a.m. CDT. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically, and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/CAG2021CAG2022.

We have decided to holdwill be holding the Annual Meeting virtually again this year due to the ongoing coronavirus (COVID-19) pandemic. In addition to supporting the health and well-being of our shareholders, employees, and their families, we believeyear. We have found that hosting a virtual Annual Meeting enables greater shareholder access, attendance and participation, improves meeting efficiency and our ability to communicate effectively with our shareholders, and reduces the cost of the Annual Meeting.costs. The Annual Meeting will include a brief report on our business, a discussion of and voting on matters described in the Notice of 20212022 Annual Meeting of Shareholders and Proxy Statement, and a question-and-answer session.

For Conagra Brands,Looking back, fiscal 20212022 was a year of successfully managing throughcontinued volatility and dynamic conditions. Newconditions in which inflation, supply chain challenges, and world events all contributed to a challenging external environment. I’m proud that our dedicated Conagra team was able to remain focused on delivering innovation, value, and superior products to create lasting connections between consumers foundand our brandsbrands. As a result, we continued to deliver strong top-line growth, both in the absolute and became repeat purchasers ofrelative to our innovative products. Wepeers, as we grew share versus the competition across our key product categories, and continued to invest in the long-term health of our business. Our dedicated employees performedWe remain confident that our customers and consumers recognize the superior relative value of our products and that our business will continue to perform well in very challenging circumstancesthese dynamic times. With fiscal year 2023 now underway, we are well-positioned to weather any coming storms and without their dedication, we could not have delivered for our consumers, customers, or shareholders. We enter fiscal 2022 believing inkeep driving toward the long-term prospects for our business.bright future on the horizon.

On behalf of our entire organization, I thank you for your shared confidence that Conagra Brands continues to be a compelling investment opportunity.

Sincerely,

Sean Connolly

President and Chief Executive Officer

20212022 PROXY STATEMENT III

Notice of 20212022 Annual Meeting of Shareholders and Proxy Statement

| When | Where | Who May Vote | ||

| Wednesday, | Online at | Shareholders of record as | ||

September 11 a.m. CDT | www.virtualshareholdermeeting.com | of the close of business on | ||

ITEMS OF BUSINESS

| 1. |

|

| 2. |

|

| 3. |

|

| 4. |

|

| 5. |

|

| 6. | Transaction of any other business properly brought before the Annual Meeting, or any postponement or adjournment thereof. |

Colleen BatchelerCarey Bartell

Executive Vice President, General Counsel

and Corporate Secretary

August 6, 202110, 2022

|

Attend Online

You are entitled to attend and participate in the Annual Meeting if you were a shareholder of record as of the close of business on |

Even if you plan to attend the Annual Meeting, please promptly vote your shares in advance by proxy.

YOUR VOTE IS IMPORTANT.

|

IV CONAGRA BRANDS

| 1 | ||||

Board of Directors & Corporate Governance

| ||||

VOTING ITEM #1: Election of Director Nominees | ||||

| Voting | 5 | |||

| Who We Are | ||||

| How We Are Selected | ||||

| How We Govern | ||||

| How We Are Compensated | ||||

Audit Matters

| ||||

VOTING ITEM #2:

Ratification of the Appointment of KPMG LLP as Our Independent Auditor for Fiscal | ||||

| Audit / Finance Committee Report | ||||

20212022 PROXY STATEMENT V

Proxy Statement

We are providing the enclosed proxy materials to you in connection with the solicitation by the Board of Directors of Conagra Brands, Inc. (referred to as Conagra Brands, Conagra or the company)Company) of proxies to be voted at the Annual Meeting of Shareholders to be held on September 15, 2021.21, 2022 (the 2022 Annual Meeting). We began making our proxy materials available to shareholders on or about August 6, 2021.10, 2022.

This summary highlights some of the information contained in this proxy statement. You should read the entire proxy statement before voting.

Our Company

Conagra Brands (NYSE: CAG), headquartered in Chicago, is one of North America’s leading branded food companies. Conagra BrandsGuided by an entrepreneurial spirit, the Company combines a rich heritage of making great food with a sharpened focus and entrepreneurial spirit. We’re committedon innovation. The Company’s portfolio is evolving to modernizing our iconicsatisfy people’s changing food brands, leveraging fresh opportunities, and adapting to a changing landscape – all with a culture that is ready to capture growth and drive shareholder value.

Conagra’spreferences. Its iconic brands such as Birds Eye®, Duncan Hines®, Healthy Choice®, Marie Callender’s®, Reddi-wip®, and Slim Jim®, as well as emerging brands, including Angie’s® BOOMCHICKAPOP®, Duke’s®, Earth Balance®, Gardein®, and Frontera®, offer choices for every occasion.

1 CONAGRA BRANDS

Our Vision

During fiscal 2021, we revisited our company’s mission and vision, and recommitted as an organization to our collective focus. At Conagra, we aspire to have the most impactful, energized, and inclusive culture in food. We seek to build a diverse team that embraces debate to challenge marketplace and business conventions. We strive to be respected for our great brands, great food, great margins, and consistent results.

By the Numbers

|

|

| ||||||

Number of |

Fiscal |

Number of | ||||||

~50 | ~$ | ~ |

Fiscal 20212022 Highlights

For Conagra Brands, fiscal 20212022 was a year of successfully managing throughcontinued volatility and dynamic conditions. Newconditions in which inflation, supply chain challenges, and world events all contributed to a challenging external environment. However, Conagra was able to remain focused on delivering innovation, value, and superior products to create lasting connections between consumers foundand our brandsbrands. As a result of taking decisive actions throughout the year, we continued to deliver strong top-line growth, both in the absolute and became repeat purchasers ofrelative to our innovative products. Wepeers, as we grew share versus the competition in each our key product categories, and continued to invest in the long-term health of our business. Our dedicated employees performedWe remain confident that our customers and consumers recognize the superior relative value of our products, and that our business will continue to perform well in very challenging circumstances and our commitment to employee health and safety remained a primary focus. We enter fiscal 2022 continuing to believe in the long-term prospects for our business.these dynamic times.

Given the dynamic environment created by the COVID-19 pandemic, we provided fiscal 2021 guidance on a quarter-to-quarter basis. Ultimately, we delivered results consistent with and in some instances above our adjusted guidance throughoutfor the fiscal year.

Net Sales Growth: 3.1% | Operating Margin: 11.7% | Diluted EPS: $1.84 |

Organic Net Sales Growth1:

|

|

| ||||||||

| 14.4% |

$2.36 |

| ||||||||||

|

|

| ||||||||

|

|

| ||||||||

|

|

|

We achieved our leverage goal for fiscal 2021 ahead of schedule.

| 1 | A reconciliation of this non-GAAP measure to the most directly comparable GAAP measure is included in Appendix A to this Proxy Statement. |

| 2 | A reconciliation of this non-GAAP measure to the most directly comparable GAAP measure is included in Appendix A to this Proxy Statement. |

| 3 | A reconciliation of this non-GAAP measure to the most directly comparable GAAP measure is included in Appendix A to this Proxy Statement. |

20212022 PROXY STATEMENT 2

Specific performance highlights from fiscal 20212022 include the following:

We experienced strong organic net sales growth in all three of our retail segments in fiscal 2021,2022, driven by increased demand due to COVID-19,growing and gaining share versus our competitors, as well as growth in e-commerce sales, and a robust innovation slate.

Our adjusted operating margin grew again in fiscal 2021. We delivered operating margin of 15.9%11.7% and adjusted operating margin of 17.5%14.4%1.4

We achieved our net leverage ratio2 goal of 3.6x, successfully implementing inflation-driven pricing in the second quarterface of fiscal 2021 – two quarters ahead of our year-end target.

historic inflation.

WeDuring fiscal 2022, we continued our portfolio sculpting work to nourish an inclusive culture that encourages openness, acceptance, and individual authenticity by introducing our multi-year Diversity and Inclusion learning journey. This important framework is rooted in fiscal 2021. We completed the divestiture or exitour Timeless Values and in our five inclusive behaviors of several smaller, non-core businesses: H.K. Anderson peanut butter-filled pretzels, Peter Panpeanut butter,genuine listening, civility, mutual respect, healthy debate, and Egg Beaters liquid eggs.compromise.

Our Board of Directors increased our quarterly dividend by 29% during fiscal 2021 and weWe paid $475$582 million in cash dividends overall. Upon achievement of our net leverage ratio ahead of schedule, we repurchased approximately $300 million of common stock.in fiscal 2022.

A reconciliation of this non-GAAP measure to the most directly comparable GAAP measure is included in Appendix A to this Proxy Statement. |

|

Investing in Our Culture: Our vision is to have the most impactful, energized, and inclusive culture in food. We believe that a diverse team and inclusive culture are key enablers of shareholder value creation. During fiscal 2021,2022, we continued our work to deliver against our vision. During the first quarter of the year, we established aOur Diversity and Inclusion Leadership Council, comprised of our Chief Executive Officer (CEO), his Senior Leadership team, and members of our Human Resources team. While the importance ofteam continued to expand and refine our diversity and inclusion are not new to Conagra, we established the Council to expand our D&I(or “D&I”) strategy, track our progress, and ensureadvance execution of our D&I goals.

The Council refreshedexecuted the company’s D&I strategic plan during fiscal 2021, and declared ato focus on recruiting, advocating for, and developing diverse talent. The Council establishedand the company re-affirmed the following goals3 for expanding diversity in our organization:

2025

At least 40% of management-level roles held by women

|

|

2025

Double people of color representation in management and middle-management roles

|

In support of the achievement of our goals, we undertook a variety of initiatives in fiscal 2021:2022, including:

| • |

|

| • | Expanding our diversity recruitment strategies focused on strengthening the diversity of candidate slates at the early talent (recent college graduates) and experienced hire levels. This year, Conagra was recognized by the Talent Board for our inclusive |

| • |

|

| • |

|

| • |

|

|

3 CONAGRA BRANDS

| • | Throughout fiscal 2022, the Human Resources Committee of our Board (the HR Committee) continued to receive regular reports from management on our D&I progress. The HR Committee has embedded D&I topics into its standing agenda and intends to continue discussing the topic regularly at all scheduled meetings in fiscal 2023. |

Fiscal 2019—20212020—2022

We maintain a long-term strategic plan at Conagra and strive to set rolling three-year financial targets that the HR Committee of our Board can incorporate into long-term incentive compensation plans for our most senior executives. The three-years ending with fiscal 20212022 were far more dynamic than originally expected. DuringWe initially focused fiscal 2019, we acquired Pinnacle Foods, improving the scale and breadth of our portfolio. We expected fiscal 2020 to be a year focused on integrating the Pinnacle Foods, Inc. (Pinnacle) business and delivering turn-around plans for several large brands acquired in the Pinnacle transaction. However, by the end of the third quarter of fiscal 2020, the COVID-19 pandemic had introduced new challenges. During fiscal 2021, we rose to the challenge of the COVID-19 pandemic, and delivered for our consumers, customers, and shareholders while keeping our employees safe. We expected fiscal 2022 to be focused on navigating increased supply chain challenges posed by the pandemic and meeting increased customer and consumer demand driven by sustained elevated levels of at-home dining. However, fiscal 2022 introduced the additional challenges of historic and persistent inflation and supply chain headwinds stemming from geopolitical turmoil. In response to these challenges, we invested in our supply chain operations and successfully implemented inflation-driven pricing, while continuing to invest in our innovation pipeline.

As a result of our team’s agility and results-orientation over the last three years, we believe that we enter fiscal 20222023 with a solid foundation from which to continue to deliver for investors.

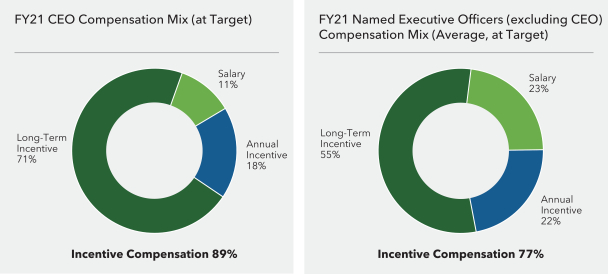

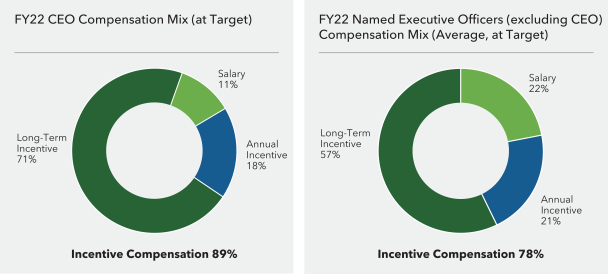

Fiscal 20212022 Compensation

For fiscal 2021, our2022, the HR Committee established an executive compensation program that was designed to promote attainment of our fiscal 20212022 operating plan and fiscal 20192022 to 20212024 long-term goals. More specifically, the program contained the following elements:

|

Incentive Compensation:

| |

• Base Salary

| • Fiscal

| |

• Health and Welfare Benefits

| • Fiscal

| |

• Retirement Benefits

|

|

2022 PROXY STATEMENT 4

In designing the program, the HR Committee chose to include a mix of compensation types (salary, benefits, cash-based incentives, and equity-based incentives) and a mix of performance periods (single year and multi-year) to promote long-term, strategic decision-making. This approach was also intended to minimize the likelihood that our executives would be motivated to pursue overly risky initiatives or unsustainable results.

89%

Percentage of our CEO’s |

6x

Our CEO’s stock ownership |

>

Level of shareholder support for our |

No

Hedging or pledging of company |

Yes

Clawback Policy in place to recoup |

Fully Independent

The HR Committee’s compensation |

2021 PROXY STATEMENT 4

As more fully described in the “Compensation Discussion and Analysis” section of thethis Proxy Statement, beginning on page 47, the HR Committee considered the positive business outcomes described above in determining final payouts under our incentive programs with performance periods concluding in fiscal 2021.2022. The HR Committee further considered the importance of maintaining employee motivation and the impact that payouts under our fiscal year 2022 annual incentive plan might have on Conagra’s ability to retain and reward those employees necessary to help Conagra meet its financial and business objectives; the many operational and strategic accomplishments during fiscal 2022 in the face of evolving and dynamic challenges; and management’s decisive actions to partially mitigate the negative impacts of various external factors that were generally outside management’s control, including unexpected historic levels of input cost inflation and elevated supply chain operating costs that drove operating results to deviate from the plan. In light of these many considerations, the Committee applied an additional discretionary [ ]% increase to the payout under the fiscal year 2022 annual incentive plan pursuant to the original design of the plan. Our Chief Executive OfficerCEO and other senior executives named in this Proxy Statement received above[ ] target payouts under both the fiscal year 20212022 annual incentive plan and no payout under the fiscal year 20192020 to fiscal year 20212022 cycle of the long-term performance share plan.

The HR Committee believes that its fiscal 20212022 compensation decisions appropriately reflect its pay-for-performance philosophy.

At the 20212022 Annual Meeting of Shareholders, we are asking shareholders to vote on the following items:

| Proposal | Board’s Voting Recommendation | |

| FOR each nominee | |

| FOR | |

| FOR | |

The approval of an amendment to our Certificate of Incorporation to allow shareholders to act by written consent | FOR | |

| AGAINST | |

5 CONAGRA BRANDS

Our Corporate Citizenship

Our Environmental and Social Responsibility

At Conagra, we believe that when our people, our communities, and the environment are nourished and thriving, so are we. As a result, we take a strategic approach to corporate citizenship. We focus our efforts on the topics we believe are most material to the food industry, to our business, and to our stakeholders: Good Food, Better Planet, Responsible Sourcing, and Stronger Communities.

A few highlights of our work follow.

Good Food

Consumers around the globe are increasingly focused on the sustainability of their diets. Conagra recognizes the Food and Agriculture Organization of the United Nations’ definition of sustainable diets, which takes into consideration the nutritional value, cultural context, and economic, social, and environmental impacts of consumer food choices. As part of our ongoing effort to promote the adoption of sustainable diets in the markets we serve, Conagra offers a variety of products made with plant protein. Plant-based brands and platforms are now significant parts of our business; in fiscal 2021, Conagra’s total ingredient buy by volume was approximately 79% plant-based. In October 2021, Conagra was acknowledged for our work in this area, receiving recognition by FAIRR as the top-ranked U.S. company in efforts to diversify toward more sustainable proteins. |

| |

5 CONAGRA BRANDS

Better Planet

Climate Change Mitigation - Conagra has committed to strive toward reducing absolute Scope 1 and 2 greenhouse gas emissions by 25% by 2030 as compared to a fiscal |

|

Our 2030 greenhouse gas emissions goals supplement the work we’ve been doing for years. Since 2009, Conagra has decreased our carbon footprint by nearly 300,000 metric tons.

Water Conservation – Our water conservation projects have conserved 3.6 billion gallons of water since 2009, including 64 million gallons of water in fiscal year 2021.2022. During fiscal 2021,2022, more than 85% of our operational water came from areas on the lower end of the World Resources Institute water risk spectrum.

Zero Waste - In fiscal year 2021, eight2022, ten of our manufacturing facilities diverted more than 95% of waste materials from landfills through recycling and other innovative waste reduction measures.

A key enabler of our sustainability work is the direct engagement of those closest to our operations: our employees. Our Sustainable Development Awards program is a cornerstone of our Better Planet strategy and uses an annual, internal competition to recognize innovative projects related to sustainable production. Each year, our employees identify, design, implement, and then submit for recognition projects that save energy, conserve water, and reduce waste.

2022 PROXY STATEMENT 6

| Responsible Sourcing |

We source goods and services in accordance with our Supplier Code of Conduct, under which suppliers are required to: reduce environmental impacts such as deforestation, greenhouse gas emissions, and waste generation; protect water resources through restorative or conservation efforts; support social needs in the communities in which they operate though philanthropic investment, diversity and inclusion efforts, and human rights practices; and support efforts to implement traceability of goods and services throughout the supply chain.

Our approach to product packaging takes environmental impacts into account while continuing to ensureprioritize food quality and safety. We are also focused on encouraging our supply chain partners to engage in sustainable agriculture practices. In September 2020, weWe recently partnered with U.S. Farmers and Ranchers in Action and other stakeholders to create the Decade of Ag Vision, a collaborative effort to restore our environment through agriculture that regenerates natural resources.

|

|

|

|

2021 PROXY STATEMENT 6

| Stronger Communities |

Corporate Ethics and Culture - Our Code of Conduct provides guideposts for how our employees and Board members are expected to conduct themselves when representing Conagra both inside and outside the company. We conduct annual trainings to ensure that employees are aware of our expectations and their obligations under the Code of Conduct.

We take pride in our culture and we’re guided by our six Timeless Values:

| • | Integrity: Doing the right things and doing things right |

| • | External focus: Centering on the consumer, customer, competitor, and investor |

| • | Broad-mindedness: Seeking out and respecting varied perspectives; embracing collaboration and assuming positive intent |

| • | Agility: Converting insights into action with the speed of an entrepreneur |

| • | Leadership by all: Simplifying, making decisions, inspiring others, and acting like an owner |

| • | Focus on results: Leveraging a “refuse-to-lose” obsession with impact and value creation |

Human Rights, Diversity and Inclusion - We seek to leverage our differences as a competitive advantage. In fiscal year 2021,2022, Conagra received a perfect score of 100% on the Human Rights Campaign’s Corporate Equality Index for the seventheighth year in a row. Our President and Chief Executive OfficerCEO is an original signatory to the CEO Action for Diversity and Inclusion™ Pledge.

As discussed above, we have developed a comprehensive strategy designed to support our efforts to increase representation of people of color and women in management roles and during fiscal 2021,have published five-year representation goals for our workforce.workforce, including striving to double our people of color representation in management and middle-manager level roles versus our fiscal 2020 baseline, and striving to have 40% of our management level roles held by people identifying as women. We plan to use recruitment, advocacy, and development initiatives to enhance the diversity of our talent and create a more inclusive workplace for all.

Employee Health & Safety - Our global Environment, Occupational Health and Safety Philosophy drives us towards continuous environment, health, and safety (“EH&S”) improvement, as measured by environmental and safety indicators implemented through our EH&S management approach. Our Occupational Safety & Health Administration incident rate during fiscal year 20212022 was 2.001.67 incidents per 100 full-time workers.workers, which was below the industry average of 5.10 for companies in the food manufacturing sector.

Community Impact & Philanthropy - We believe in giving back to the communities in which we live and work. Employee volunteerism, product donations, and financial contributions are all a part of our community impact approach. Each year Conagra Brands employees participate in activities to recognize Hunger Action Month in September, participate in our United for Change fundraising campaign during the fall, and volunteer during our annual Month of Service in April. While we engage on an array of topics, we recognize the unique opportunity we have to a make a difference in the global effort to end food insecurity.

7 CONAGRA BRANDS

Top 50

|

25 million meals

In fiscal

|

7 CONAGRA BRANDS

Our Commitment to Good Governance

Our Board is committed to performing its responsibilities in a manner consistent with sound governance practices. It routinely reviews its processes, assesses the regulatory and legislative environment, communicates with investors, and adapts governance practices as needed to support informed, competent, and independent oversight on behalf of our shareholders. Examples of practices discussed in more detail throughout this proxy statement include the following:

Independent Board Leadership

|

The Board believes that independent Board leadership is a critical component of our governance structure. Since 2005, our Board

| |

Majority Voting in Uncontested Director Elections |

To be elected in an uncontested election, a director nominee must receive the affirmative vote of a majority of the votes cast in the election. If an incumbent nominee is not elected,

| |

Proxy Access

|

Our Amended and Restated Bylaws, (the “Bylaws”) permit shareholders to nominate directors through proxy access. Any shareholder, or group of up to 20 shareholders collectively, owning at least 3% of the outstanding shares of Conagra Brands common stock continuously for at least three years may nominate director candidates for inclusion in our proxy materials.

| |

Board Refreshment

|

As of August

|

2022 PROXY STATEMENT 8

Board Diversity

|

The Board values diversity and strives to build a group that delivers diverse views, perspectives, backgrounds, and experiences. As of August

•

• Our average age was

• 75% of our Board’s leadership positions were held by women

|

2021 PROXY STATEMENT 8

Board’s Role in Risk Oversight |

Each of the Board and its key standing committees plays an active part in overseeing enterprise risk. The Board and its Committees routinely receive updates from management and external advisors on critical risk areas, including, but not limited to, overall | |

Board’s Role in Overseeing Environmental, Social, and Governance Issue (“ESG”) | The Nominating and Corporate Governance Committee is responsible for reviewing with management investor and other stakeholder expectations for the company’s ESG goals, policies and practices, and the company’s progress against ESG goals (except as reviewed by another committee), as well as its material corporate citizenship and social responsibility reports.

| |

Board’s Role in Overseeing Human Capital Management |

The

• talent acquisition, development, assessment, and retention • employee health and wellness

• diversity and inclusion

•

• the company’s culture and its connection to the company’s overall

|

9 CONAGRA BRANDS

| ||||

“

– Sean Connolly

| ||||

|

9 CONAGRA BRANDS2022 PROXY STATEMENT 10

Currently, the Board consists of 12 directors whose terms expire at the 20212022 Annual Meeting. Ms. Joie Gregor, Mr. Rajive Johri and Mr. Craig Omtvedt, three of our directors, have turned 72, Conagra’s retirement age under its Corporate Governance Principles. As a result, these directors will not stand for re-election at the 2022 Annual Meeting and their terms on the Board will expire at the conclusion of the 2022 Annual Meeting. Our Board thanks Ms. Gregor, Mr. Johri, and Mr. Omtvedt for their many years of exemplary service to Conagra.

Based on the recommendation of the Board’s Nominating and Corporate Governance Committee, the Board has nominated 12nine current directors, as named in this Proxy Statement, for election at the 20212022 Annual Meeting.

The following biographies detail the age and principal occupations during at least the past five years for each director nominee; the year the nominee was first appointed to the Board; and the public company directorships they now hold and have held.

If elected, each of the directors will hold office until the Conagra Brands 20222023 Annual Meeting of Shareholders, and until their successors have been elected and qualified. We have no reason to believe that any of the nominees for director will be unable to serve if elected.

Anil Arora

Age:

Director Since:

July 17, 2018

Independent

Board Committees:

• Human Resources Committee

At the conclusion of the 2022 Annual Meeting Mr. Arora will begin serving as a member of the Nominating and Corporate Governance Committee. |

| Other public company directorships:

• Ping Identity Holding Corp. from 2022 to present • ON24, Inc. from 2022 to present •Envestnet, Inc. to 2021 • Yodlee, Inc. (as Chairman)

Experiences, qualifications, and skills considered in re-nominating Mr. Arora:

• Public Company Experience; Former C-Suite Executive: Strong leadership capabilities and insights from experience as President and

• Technology Expertise: Extensive experience in technology, operating at the intersection of the consumer, internet, and technology sectors.

• M&A Experience: Led Yodlee through its growth from start-up through ultimate acquisition. |

|

| Mr. Arora served as Vice

Prior to joining Yodlee, Inc. Mr. Arora served in various positions with Gateway, Inc.

Earlier in his career, Mr. Arora served in various strategy and marketing positions for The Pillsbury Company

|

|

11 CONAGRA BRANDS2022 PROXY STATEMENT 12

Thomas “Tony” K. Brown

Age:

Director Since:

October 15, 2013

Independent

Board Committees:

• Audit / Finance Committee • Nominating and Corporate Governance Committee | Other public company directorships:

• 3M Company

• Tower International, Inc.

Experiences, qualifications, and skills considered in re-nominating Mr. Brown:

• Public Company Experience; Former C-Suite Executive: Understanding of governance issues facing public companies from his board service to other public companies; broad leadership capabilities and insights from his experience in leadership roles at Ford Motor Company and other companies.

• International Expertise: Vast experience in global purchasing and supply chain at Ford Motor Company and other companies. | Mr. Brown served as Group Vice President, Global Purchasing with Ford Motor Company

Prior to joining Ford Motor Company, Mr. Brown served in leadership positions at United Technologies Corporation |

2021 PROXY STATEMENT 12

|

|

|

|

13 CONAGRA BRANDS

Manny Chirico Age: 65 Director Since: February 1, 2021 Independent Board Committees: • Audit / Finance Committee | Other public company directorships: • Dick’s Sporting Goods, Inc. since 2003 • PVH Corp. from 2005 until 2021 Experiences, qualifications, and skills considered in nominating Mr. Chirico: •Public Company Experience; Former C-Suite Executive: Strong leadership capabilities and insights from experiences as Chair, CEO of PVH Corp. and through additional executive positions with PVH Corp. over two decades. Broad understanding of governance issues facing public companies from his board service to other public companies. •Market Facing Experience; International Expertise: Substantial international business and management experience from service as Chair and Chief Executive Officer of a public company with global operations. •Finance / Capital Management Expertise; Risk Management Expertise: Deep expertise in finance, risk and compliance oversight based on roles of increasing responsibility, including as a Controller, CEO, and as Chief Operating Officer at a public company. •M&A Experience: Significant transactional experiences as an executive and board member. | Mr. Chirico served as CEO of PVH Corp. from 2006 until his retirement in 2021, and as its Chair from 2007 to 2021. Prior to serving as its CEO, Mr. Chirico served in various roles of increasing responsibility with PVH Corp., including as Controller, Chief Financial Officer, and President and Chief Operating Officer. Prior to joining PVH Corp., Mr. Chirico was a Partner at Ernst & Young LLP and ran its Retail and Apparel Practice Group. |

2022 PROXY STATEMENT 14

Sean M. Connolly

Age:

Director Since:

April 6, 2015

Not Independent

Board Committees:

• Executive Committee |

| Other public company directorships:

• The Hillshire Brands Company from June 2012 to August 2014

Experiences, qualifications, and skills considered in re-nominating Mr. Connolly:

• Public Company Experience; Active C-Suite Executive: Broad understanding of governance issues facing public companies from his board service to other public companies as well as from his current board service to privately held S.C. Johnson & Son, Inc.

• Market Facing Experience: Extensive career focused on and committed to building leading consumer brands in the food industry.

• M&A Experience: Transactional experience during his tenure with several companies in the consumer packaged goods industry. |

|

| Mr. Connolly has served as our President and

Previously, he served as President and

Prior to joining Sara Lee in anticipation of the spin-off of Hillshire, Mr. Connolly served as President of Campbell North America, the largest division of Campbell Soup

|

|

2021 PROXY STATEMENT 14

|

|

|

15 CONAGRA BRANDS

Age:

Director Since:

Independent

Board Committees:

• Audit / Finance Committee

| Other public company directorships:

•

Experiences, qualifications, and skills considered in re-nominating

• Public Company Experience; Active C-Suite Executive:Strong leadership

•

• International Expertise: Substantial international business and management experience from | Mr. Dowdie has been the Executive Vice President of Global Supply Chain of Starbucks, Corp. since October 2020. His prior role with Starbucks was as the Senior Vice President of Global Food Safety, Quality & Regulatory (from January 2013 to October 2020). Prior to joining Starbucks, Mr. Dowdie held leadership roles at Campbell Soup Company, Seagram Co., Ltd., and Frito-Lay, related to supply chain management, food safety and quality strategy, research and development, new product development and commercialization, innovation management, and new business development.

|

|

20212022 PROXY STATEMENT 16

Horowitz

Age:

Director Since:

Independent

Board Committees:

• Audit / Finance Committee

| Other public company directorships:

•

Experiences, qualifications, and skills considered in re-nominating • Public Company Experience;

• Finance / Capital Management

• International Expertise:Substantial international business and management experience from Abercrombie & Fitch Co. and prior service to |

|

| Ms. Horowitz has been the CEO of Abercrombie & Fitch Co. since February 2017. Prior to that, she was President and Hollister from October 2014 to December 2015. Prior to joining |

17 CONAGRA BRANDS

Richard H. Lenny

Age:

Director Since:

March 17, 2009

Non-Executive

May 28, 2018

Independent

Board Committees:

• Executive Committee (Chair)

• Human Resources Committee

• Nominating and Corporate Governance Committee

As Board Chair, Mr. Lenny is also deemed an ex-officio member of the

| Other public company directorships:

• Discover Financial Services

• Illinois Tool Works Inc.

• McDonald’s Corporation

Experiences, qualifications, and skills considered in re-nominating Mr. Lenny:

• Public Company Experience; Former C-Suite Executive: Broad understanding of governance issues facing public companies from his board service to other public companies; strong leadership capabilities and insights, particularly with major consumer brands based on his lengthy career in the food industry.

• Market Facing Experience; International Expertise: Deep knowledge of strategy, marketing, and business development in the consumer products food industry domestically and abroad from his lengthy career in leadership roles in global food companies. | Mr. Lenny served as

Prior to joining The Hershey Company, Mr. Lenny served as Group Vice President of Kraft Foods, Inc.

Mr. Lenny served as non-executive |

20212022 PROXY STATEMENT 18

Melissa Lora

Age:

Director Since:

January 4, 2019

Independent

Board Committees:

• Audit / Finance Committee (Chair) • Executive Committee At the conclusion of the 2022 Annual Meeting, Ms. Lora will begin serving as a member of the Nominating and Corporate Governance Committee. | Other public company directorships:

• KB Home

• MGIC Investment Corporation

Experiences, qualifications, and skills considered in re-nominating Ms. Lora:

• Public Company Experience; Former C-Suite Executive: Strong leadership capabilities and insights from her experience in various leadership roles at Taco Bell Corp.; broad understanding of governance issues facing public companies from her board service to other public companies, including as lead independent director of KB Home.

• Market Facing Experience; International Expertise: Substantial international business and management experience from service as President of Taco Bell International.

• Finance / Capital Management Expertise; Risk Management Expertise: Deep expertise in finance, risk, and compliance oversight from more than a decade of service as Chief Financial Officer of an operating division (Taco Bell Corp.) of Yum! Brands, Inc., as well as a decade of service as the Chair of the Audit Committee of KB Home.

| Ms. Lora served as President of Taco Bell International, a segment of Taco Bell Corp. |

19 CONAGRA BRANDS

Ruth Ann Marshall

Age:

Director Since:

May 23, 2007

Independent

Board Committees:

• Executive Committee

• Human Resources Committee (Chair)

• Nominating and Corporate Governance Committee |

| Other public company directorships:

• Global Payments Inc.

• Regions Financial Corporation

Experiences, qualifications, and skills considered in re-nominating Ms. Marshall:

• Public Company Experience; Former C-Suite Executive: Strong leadership capabilities and insights from her service to MasterCard International, Inc., including marketing, account management and customer service; broad understanding of governance issues facing public companies from her board service to other public companies.

• Market Facing Experience; International Expertise; Technology Expertise: Significant domestic and international experience in growing the MasterCard Americas business, including through new product development; technology expertise built through a career in the payments technology industry.

• Finance / Capital Management Expertise; Risk Management Expertise: Expertise in finance from her service to MasterCard and on the Audit Committee of Regions Financial and transactional experience from her board service to other public companies. |

|

| Ms. Marshall was President of the Americas at MasterCard International, Inc.

Prior to joining MasterCard International, Inc., Ms. Marshall served as Senior Executive Vice President of Concord EFS, Inc. |

|

20212022 PROXY STATEMENT 20

|

|

| ||||||||||

|

|

|

21 CONAGRA BRANDS

The Board desires that its membership collectively hold a broad range of skills, education, experiences, qualifications, and qualificationscharacteristics, including diversity, that can be leveraged for the benefit of the company and its shareholders. Not only must individuals exhibit high standards for ethics and integrity to be nominated for Board service, they must be willing to commit the time needed to faithfully carry out a director’s duties, including overseeing our strategy, CEO succession planning, and director refreshment processes.

We seek to maintain a Board comprised predominately of independent directors. In addition to independence, we seek individuals with the following experiences, skills, and characteristics:

|

|

|

|

|

|

|

| |||||||

| Public company board experience | Active or former C-Suite executive | Market-facing experience | International expertise | Finance/capital management expertise | M&A experience | Technology expertise | Risk management expertise |

Our Nominating and Corporate Governance Committee plays a key role in identifying candidates for the Board who fulfill these requirements. More information on director recruitment and selection processes can be found in the “Director Nomination Process” section of this Proxy Statement.

The following matrix summarizes, for each director nominee and as of August 2, 2021,10, 2022, the skills they bring to the Board, their age and Board tenure, their independence, and other qualities and characteristics that contribute to our goal of building a Board of diverse views, perspectives, backgrounds, and experiences.

Director

| Experiences and Skills

| Age

| Tenure

| Independent

|

Race / Ethnic

| Gender

| LGBTQ+1

| Experiences and Skills

| Age

| Tenure (Years)

| Independent

|

Race / Ethnic

| Gender

| LGBTQ+1

| ||||||||||||||

Arora |         | 60 | 3 |  |  |

|

|         | 61 | 4 |  |

|

|

| ||||||||||||||

Brown |        | 65 | 8 |  |  |

|

|        | 66 | 9 |  |  |

|

| ||||||||||||||

Chirico |        | 64 | ~1 |  |

|

|

|        | 65 | 2 |  |

|

|

| ||||||||||||||

Connolly |        | 55 | 6 | CEO |

|

|

|        | 57 | 7 | CEO |

|

|

| ||||||||||||||

Gregor |       | 71 | 13 |  |

|  |

| |||||||||||||||||||||

Dowdie |        | 67 | <1 |  |  |

|

| |||||||||||||||||||||

Horowitz |      | 57 | ~1 month |  |

|  |

|      | 58 | 1 |  |

|  |

| ||||||||||||||

Johri |         | 71 | 13 |  |  |

|

| |||||||||||||||||||||

Lenny |       | 69 | 12 |  |

|

|

|       | 70 | 13 |  |

|

|

| ||||||||||||||

Lora |         | 59 | ~3 |  |

|  |

|         | 60 | 3 |  |

|  |

| ||||||||||||||

Marshall |        | 67 | 14 |  |

|  |  |        | 68 | 15 |  |

|  |  | ||||||||||||||

Omtvedt |       | 71 | 5 |  |

|

|

| |||||||||||||||||||||

Ostfeld |      | 44 | ~3 |  |

|

|

| |||||||||||||||||||||

Average/Total |

| 63 | 7 years | 11 (92%) | 3 (27%) | 4 (33%) | 1 (9%) |

| 63 | 6 | 8 (89%) | 3 (33%) | 3 (33%) | 1 (11%) | ||||||||||||||

| 1 | Based on director nominees’ self-identified characteristics. |

21 2021 PROXY STATEMENTCONAGRA BRANDS 22

Our Nominating and Corporate Governance Committee plays a key role in identifying candidates for the Board who fulfill these requirements. More information on director recruitment and selection processes can be found beginning on page 31 of this Proxy Statement.

Director Refreshment

As noted in the table above, sixour Board represents a mix of long-tenured directors and new perspectives, insights, expertise, and experiences, with five of our director nominees havehaving a tenure on our Board of less than five years, of experience on our Board and this is intentional.

The Board uses refreshment processes to enable it to evaluate the continued alignment of the Board’s membership with the needs of Conagra Brands. The Board’s refreshment processes involve reviewing and modifying the skills and characteristics required for membership. The Board also enables planned refreshment through its maintenanceretirement policy, pursuant to which no director may be nominated to a new term if he or she would be over age 72 at the time of a mandatory retirement agethe election. In accordance with this policy, Ms. Joie Gregor, Mr. Rajive Johri, and Mr. Craig Omtvedt have not been nominated for directors.

As a result of our refreshment processes, our Board represents a mix of long-tenuredre-election as directors and directors who provide new and different insights, expertise, and experiences.at the 2022 Annual Meeting.

Director Independence

To be considered independent, the Board must affirmatively determine that a director has no material relationship with Conagra Brands. In making its independence determinations, the Board applies the listing standards of the New York Stock Exchange or NYSE,(the NYSE), and the categorical independence standards contained in our Corporate Governance Principles. The Board considers even immaterial relationships, including transactions, relationships, and arrangements with the company, in its decision-making process to ensure a complete view of each director’s independence.

The Board has determined that 11 of our 12 current directors – directors Arora, Brown, Chirico, Dowdie, Gregor, Horowitz, Johri, Lenny, Lora, Marshall, and Omtvedt – have no material relationships with Conagra Brands and are independent within the meaning of applicable independence standards. The Board has also determined that 8 of our 9 nominees for director – directors Arora, Brown, Chirico, Gregor,Dowdie, Horowitz, Johri, Lenny, Lora, Marshall, Omtvedt and OstfeldMarshall – have no material relationships with Conagra Brands and are independent within the meaning of applicable independence standards. The Board also determined that Stephen Butler,Scott Ostfeld, who served as a director until his retirement in September 2020,April 2022, had no material relationships with Conagra Brands and was independent within the meaning of applicable independence standards. Mr. Connolly is not considered to be independent due to his employment with Conagra Brands.

To take a holistic approach to its independence determinations, the Board also reviewed commercial relationships between Conagra Brands and companies on whose boards our nominees served during fiscal 2021.2022. The relationships with these companies involved Conagra Brands’ purchase or sale of products and services in the ordinary course of business on arm’s-length terms in amounts and under other circumstances that did not affect the relevant directors’ independence under our Corporate Governance Principles or under applicable law and NYSE listing standards.

In addition to satisfying our independence standards, each member of the Audit / Finance Committee of the Board must satisfy an additional Securities and Exchange Commission or SEC,(SEC) independence requirement. This requirement provides that the member may not accept, directly or indirectly, any consulting, advisory or other compensatory fee from us or any of our subsidiaries other than his or her director’s compensation and may not be an “affiliated person” of Conagra Brands. Each member of the Audit / Finance Committee satisfies this additional independence requirement.

The SEC and NYSE have also adopted heightened standards relating to the independence of members of the Human Resources Committee, which we refer to as the HR Committee. These standards require consideration of the source of HRHuman Resources Committee members’ compensation, including any consulting, advisory or other compensatory fees paid to an HRa Human Resources Committee member, and each HRHuman Resources Committee member’s affiliation with us, any of our subsidiaries or any affiliates of our subsidiaries. Each member of the HRHuman Resources Committee satisfies these additional independence requirements.

23 CONAGRA BRANDS2022 PROXY STATEMENT 22

The Board is committed to performing its responsibilities in a manner consistent with sound governance practices. It routinely reviews its processes, assesses the regulatory and legislative environment, communicates with investors, and adapts its governance practices as needed to support informed, competent, and independent oversight on behalf of our shareholders. Our Corporate Governance Principles provide a summary of these practices and are available on our website at http://www.conagrabrands.com/investor-relations/corporate-governance/principles. Highlights of our corporate governance practices include the following:

Fully Independent Key Committees

| Critical aspects of the Board’s work are handled by three key standing committees, each of which is comprised solely of independent directors: an Audit/Finance Committee, a Human Resources Committee, and a Nominating and Corporate Governance Committee.

| |

Annual Election of Directors

|

To promote accountability to shareholders, our directors stand for election on an annual basis.

| |

Majority Voting in Uncontested Director Elections |

To be elected in an uncontested election, a director nominee must receive the affirmative vote of a majority of the votes cast in the election. If an incumbent nominee is not elected, he or she is required to promptly tender a resignation to the Board, subject to acceptance

| |

Regularly-Scheduled Executive Sessions |

The Board meets on a regularly scheduled basis and holds an independent executive session at every regularly scheduled meeting of the Board and its respective committees. The

| |

Independence |

The Board has determined that

|

23 2021 PROXY STATEMENTCONAGRA BRANDS 24

Independent Board Leadership |

The Board believes that independent Board leadership is a critical component of our governance structure. Since 2005, our Board

| |

Director Attendance |

During fiscal

Board members are required to attend the company’s annual meeting of shareholders each year. All of the directors serving at the time of the

| |

Board, Committee, |

Each of the Board, the Audit / Finance Committee, the HR Committee, and the Nominating and Corporate Governance Committee conducts a self-evaluation of its performance on an annual basis. In addition, individual director evaluations are conducted annually.

| |

Retirement Age

|

No director may be nominated to a new term if he or she would be over age 72 at the time of the election. As previously noted, in accordance with this policy, current directors Joie Gregor, Rajive Johri, and Craig Omtvedt have not been nominated for re-election as directors at the 2022 Annual Meeting.

| |

Orientation and Continuing Education |

We conduct an orientation program for each new director as soon as possible following his or her election or appointment. The orientation includes presentations by senior management with respect to a wide range of topics, including our strategic plans, governance practices, control environment, and human capital management priorities.

Board members receive materials and briefing sessions to continue their education on subjects that assist them in the discharge of their duties. We also provide reimbursement of expenses associated with our independent directors’ attendance at one outside director education program each fiscal year.

|

25 CONAGRA BRANDS2022 PROXY STATEMENT 24

| Proxy Access |

Our Amended and Restated

|

Board Leadership Structure

The Board believes that independent Board leadership is a critical component of our governance structure. Our Corporate Governance Principles require us to have either an independent Board Chair or, if the positions of Chair and CEO are held by the same person, an independent lead director. Since 2005, our Chair and CEO roles have been separate. With separateThe Board believes this current structure of separating the roles of Chair and CEO roles,allows our CEO canto focus his time and energy on setting the strategic direction for the company, overseeingoversee daily operations, engagingengage with external constituents, developingdevelop our leaders, buildingbuild our culture, and promotingpromote employee engagement at all levels of the organization. Meanwhile, this structure allows our independent Chair leadsto lead the Board in the performance of its duties by establishing agendas and ensuring appropriate meeting content, engaging with the CEO and senior leadership team between Board meetings on business developments, and providing overall guidance to our CEO as to the Board’s views and perspectives, particularly on the strategic direction of the company. The Board also believes this leadership structure, coupled with independent directors serving as Chairs of each of our three key standing Board committees, enhances the Board’s effectiveness in providing independent oversight of material risks affecting the company and fulfilling its risk oversight responsibility.

Board Committees —– Overview

The Board has established four standing committees: the Audit / Finance Committee, the Executive Committee, the HR Committee, and the Nominating and Corporate Governance Committee. The Audit / Finance Committee, HR Committee and Nominating and Corporate Governance Committee operate under written charters that have been approved by the full Board; each of these three committees is comprised entirely of independent directors.

25 2021 PROXY STATEMENTCONAGRA BRANDS 26

Membership on each of the Board’s standing committees as of August 2, 202110, 2022 is as follows:

| Name | Audit / Finance Committee | Executive Committee | HR Committee | Nominating and Corporate Governance Committee | Audit / Finance Committee | Executive Committee | HR Committee | Nominating and Corporate Governance Committee | ||||||||

Anil Arora |  |  | ||||||||||||||

Tony Brown |  |  |  |  | ||||||||||||

Manny Chirico |  |  | ||||||||||||||

Sean M. Connolly |  |  | ||||||||||||||

Joie A. Gregor |  |  | Chair | |||||||||||||

George Dowdie |  | |||||||||||||||

Joie A. Gregor(1) |  |  | Chair | |||||||||||||

Fran Horowitz |  |  | ||||||||||||||

Rajive Johri |  |  | ||||||||||||||

Rajive Johri(1) |  |  | ||||||||||||||

Richard H. Lenny | Chair |  |  | Chair |  |  | ||||||||||

Melissa Lora | Chair |  | Chair |  | ||||||||||||

Ruth Ann Marshall |  | Chair |  |  | Chair |  | ||||||||||

Craig P. Omtvedt |  | |||||||||||||||

Craig P. Omtvedt(1) |  | |||||||||||||||

Scott Ostfeld |  | |||||||||||||||

Total Meetings in FY2021 | 10 | -- | 5 | 6 | ||||||||||||

Total Meetings in FY2022 | 10 | -- | 5 | 6 | ||||||||||||

| (1) | These directors have not been nominated for re-election as directors and will not stand for re-election at the 2022 Annual Meeting. At the conclusion of the 2022 Annual Meeting, Mr. Lenny will serve as Chair of the Nominating and Corporate Governance Committee. |

Executive Committee

The Executive Committee exists to act on behalf of the Board between meetings as exigency requires or at the request of the full Board. Its membership includes the Board Chair, the Chairs of each other standing Committee, and the Chief Executive Officer.CEO. During fiscal 2021,2022, its membership was comprised of Directors Connolly, Gregor, Lenny (who served as Committee Chair), Lora, and Marshall. It did not meet.

27 CONAGRA BRANDS2022 PROXY STATEMENT 26

Audit / Finance Committee

Committee Members:

| Primary Responsibilities

| |||||||

Tony Brown

Manny Chirico

George Dowdie Fran

Rajive

Melissa Lora, Chair

Craig P.

* Messrs. Johri and Omtvedt have not been nominated for re-election as directors at the 2022 Annual Meeting. At the conclusion of the 2022 Annual Meeting Ms. Fran Horowitz will cease serving on the Audit/Finance Committee and will begin serving as a member of the HR Committee. |

| |||||||

Financial Expertise and Financial Literacy

The Board has determined that each director who served on the Audit / Finance Committee during fiscal 2021 (including Mr. Stephen Butler, who retired in September 2020)2022 is financially literate within the meaning of NYSE rules and independent in accordance with SEC rules, NYSE listing standards, and the company’s independence standards. The Board also determined that directors Butler, Chirico, Johri, Lora, and Omtvedt are qualified as audit committee financial experts within the meaning of SEC regulations.

Related-Party Transactions

The Audit / Finance Committee has adopted a written policy regarding the review, approval, and ratification of related-party transactions. the Audit / Finance Committee’s responsibility for the review, approval, ratification, and oversight of related-party transactions (generally, transactions involving an amount in excess of $120,000 in which the company was, is, or will be a participant and in which a director, director nominee, executive officer, more than 5% shareholder, or immediate family member of any of the foregoing had, has or will have a direct or indirect material interest). Under the

27 CONAGRA BRANDS

policy, all related-party transactions are subject to reasonable prior review and approval by the Audit / Finance Committee. In circumstances where it is not reasonable or practical to wait until the next Audit / Finance Committee meeting to review a proposed related-party transaction, the chair of the Audit / Finance Committee may review and approve such related-party transaction. Any such approval must be reported to and ratified by the Audit / Finance Committee at its next regular, in-person meeting.

In determining whether to approve or ratify a related-party transaction, the Audit / Finance Committee will take into account, among other factors it deems appropriate, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related-party’s interest in the transaction. No director is permitted to participate in any approval of a related-party transaction in which he or she is a related party, except that the Board member will provide all material information concerning the

2021 PROXY STATEMENT 28

related party transaction to the Audit / Finance Committee. On at least an annual basis, the Audit / Finance Committee reviews and assesses ongoing related-party transactions to determine whether they comply with the company’s guidelines and that the relationships remain appropriate. All related-party transactions are disclosed to the full Board.

During fiscal 2021, one2022, no related party transactiontransactions arose. David B. Biegger served as the company’s Executive Vice President and Chief Supply Chain Officer until his retirement at fiscal year-end. One of Mr. Biegger’s immediate family members is employed by the company as a Senior Brand Manager and earned total compensation in excess of $120,000. The immediate family member’s position did not report, directly or indirectly, to Mr. Biegger. In addition, the individual is compensated in a manner that is appropriate for their responsibilities and experience and in accordance with standard compensation practices available to other individuals in comparable roles. The relationship described was reviewed and ratified in accordance with our policy for review of transactions with related persons.

Human Resources Committee

Committee Members:

| Primary Responsibilities

| |||||||

Anil Arora

Joie A.

Richard H. Lenny

Ruth Ann Marshall, Chair

* Ms. Gregor has not been nominated for |

| |||||||

2022 PROXY STATEMENT 28

Executive and Director Compensation

The HR Committee has retained authority over the determination of executive and non-employee director compensation, subject only to the further involvement of the other independent directors with respect to the approval of the overall compensation for non-employee directors and any base salary change for the CEO.directors. The HR Committee may delegate its responsibilities to subcommittees comprised of one or more HR Committee members or to selected members of management, subject to requirements of our Bylaws and applicable laws, regulations, and the terms of

29 CONAGRA BRANDS

shareholder-approved compensation plans. Additional information about the HR Committee’s processes for determining executive compensation, as well as the role of executive officers and the HR Committee’s compensation consultant in those determinations, can be found in the “Compensation Discussion and Analysis” section of this Proxy Statement.

Human Capital Management

In addition to leading the Board’s oversight of senior executive succession planning, the HR Committee oversees management’s work related to ensuringhelping employees at all levels of the company areremain fully engaged and realizingrealize their potential. The HR Committee’s review of the company’s human capital management initiatives includes, but is not limited to:to, the following items for the Senior Leadership Team and employees generally:

| • | talent acquisition, development, assessment, and |

| • | employee health and wellness; |

| • | diversity and inclusion initiatives, goals and results; |

| • | employee policies and related compliance matters; and |

| • | the company’s culture, and its connection to the company’s overall strategy. |

The HR Committee receives regular reports from management and, for some topics, external advisors, on the company’s talent strategy. During fiscal 2021,2022, the Committee reviewed topics including:

| • | our diversity and inclusion strategy; |

| • | trends in workforce and workplace management, particularly in light of |

| • | opportunities to further leverage technology in developing workforce analytics. |

The HR Committee also reviews the human capital strategic plan and progress on work underway to ensurehelp Conagra achievesachieve its vision of having the most energized, highest impact culture in food.

Compensation Committee Interlocks and Insider Participation

The individuals listed in the table above are the only individuals to have served on the HR Committee during fiscal 2021.2022. During fiscal 2021,2022, no member of the HR Committee was an employee, officer, or former officer of the company. None of our executive officers served during fiscal 20212022 on the board of directors or compensation committee (or other committee serving an equivalent function) of any entity that had an executive officer serving as a member of our Board or the HR Committee.

Additional information about the roles and responsibilities of the HR Committee is provided in the “Compensation Discussion and Analysis” section of this Proxy Statement.

29 2021 PROXY STATEMENTCONAGRA BRANDS 30

Nominating and Corporate Governance Committee

Committee Members:

| Primary Responsibilities

| |||||||

Tony Brown

Joie A. Gregor,

Rajive

Richard H.

Ruth Ann Marshall * Ms. Gregor and Mr. Johri have not been nominated for re-election as directors at the 2022 Annual Meeting. At the conclusion of the 2022 Annual Meeting Mr. Lenny will begin serving as Chair of the Nominating and Corporate Governance Committee, and Mr. Anil Arora and Ms. Melissa Lora will begin serving as members of the Nominating and Corporate Governance Committee. |

| |||||||

Director Nomination Process

The Nominating and Corporate Governance Committee considers Board candidates suggested by Board members, management, and shareholders. During fiscal 2021,2022, the Nominating and Corporate Governance Committee also retained a third-party search firm to identify director candidates. The Nominating and Corporate Governance Committee provided the third-party search firm with guidance as to the skills, experience and qualifications that the Nominating and Corporate Governance Committee was seeking in potential candidates, including requesting that the initial pool of candidates presented by the third-party search firm include [gender- and racially/ethnically-]diverse candidates, and the search firm identified candidates for the Nominating and Corporate Governance Committee’s consideration.

When a potential candidate is brought to the Board’s attention, the Nominating and Corporate Governance Committee makes an initial determination as to whether to conduct a full evaluation of the individual. This initial determination is based on whether additional Board members are necessary or desirable. It is also based on whether, based on the information provided or otherwise available to the Nominating and Corporate Governance Committee, the prospective nominee is likely to satisfy the evaluation factors described below. If the Nominating and Corporate Governance Committee determines that additional consideration is warranted, it may request a third-party to gather additional information about the prospective director candidate. The Nominating and Corporate Governance Committee may also elect to interview a candidate.

Although the Nominating and Corporate Governance Committee does not have specific minimum qualifications that must be met for a candidate to be nominated as a director, the Nominating and Corporate Governance Committee evaluates each prospective director candidate against the following standards and qualifications, among others, including those set forth in our Corporate Governance Principles, including, but not limited to:Principles:

| • | Board skill needs, |

| • | the candidate’s background, including demonstrated high standards of ethics and integrity, as well as the candidate’s ability to work toward business goals with other Board members; |

2022 PROXY STATEMENT 30

| • | diversity, including diversity of race, ethnicity, gender and age, and the extent to which the candidate reflects the composition of our constituencies; |

| • | whether the candidate has sufficient time to effectively carry out the duties of a director; |

31 CONAGRA BRANDS

| • | the candidate’s qualifications as independent and ability to serve on various committees of the Board; and |

| • | business experience, which should reflect a broad level of experience at the policy-making level. |

In evaluating potential director nominees, the Nominating and Corporate Governance Committee assesses whether the Board, collectively, represents diverse views, perspectives, backgrounds, and experiences that will enhance the Board’s and our effectiveness. The Nominating and Corporate Governance Committee seeks directors who have qualities to achieve the goal of a well-rounded, diverse Board as a whole, including through the consideration of diversity in professional experience, skills, board tenure, race, ethnicity, gender, and age.

After completing its evaluation process, the Nominating and Corporate Governance Committee makes a recommendation to the Board as to who should be nominated, and the Board determines the director nominees after considering the Nominating and Corporate Governance Committee’s recommendations.

This evaluation procedure is the same for all candidates, including director candidates identified by shareholders.

During fiscal 2022, George Dowdie joined the Board. Mr. Dowdie was identified as a director candidate by a third-party search firm. After evaluating Mr. Dowdie in the manner described above and considering input from our other independent directors and our CEO, the Nominating and Corporate Governance Committee identified Mr. Dowdie as a director candidate and recommended Mr. Dowdie as a nominee to the Board. The evaluation process for nominees recommended by shareholders does not differ fromBoard unanimously approved the process set forth above. recommendation.

Ability of Shareholders to Nominate Directors via Proxy Access or Advance Notice

Shareholders wishing to submit candidates for election as directors must notify our Corporate Secretary in writing by delivering or mailing a notice to our principal executive offices at 222 W. Merchandise Mart Plaza, Suite 1300, Chicago, Illinois 60654. Such submissions must comply with the requirements set forth in our Bylaws, including advance notice procedures.

Shareholders may also directly nominate candidates pursuant to our “proxy access” Bylaws.

Ability of Shareholders to Nominate Directors via Proxy Access

If a shareholder or group of shareholders wishes to nominate a candidate directly, they may also do so in accordance with the provisions set forth in our Bylaws. Specifically, our Bylaws permit any shareholder, or group of up to 20 shareholders collectively owning 3% or more of our outstanding shares of common stock continuously for at least three years to nominate and include in our proxy materials director nominees for election to the Board. A shareholder or shareholders, as applicable, can nominate up to the greater of:

| • | 20% of the total number of directors on the Board, rounding down to the nearest whole number, and |

| • | two directors, |

all in accordance with the requirements set forth more fully in our Bylaws.

Under our Bylaws, requests to include shareholder-nominated candidates for director in our proxy materials through this process must be received no earlier than 150 days and no later than 120 days prior to the first anniversary of the date on which our definitive proxy statement for the prior year’s annual meeting of shareholders was first released to shareholders.

During fiscal 2021, Mr. Manny Chirico joined the Board. Mr. Chirico was identified as a director candidate by a third-party search firm. After evaluating Mr. Chirico in the manner described above and considering input from our other independent directors and our CEO, the Nominating and Corporate Governance Committee identified Mr. Chirico as a director candidate and recommended him as a nominee to the Board. The Board unanimously approved the recommendation.

The Board’s Role in Risk Oversight

Our senior leadership is responsible for identifying, assessing, and managing our exposure to risk. The Board and its committees play an active role in overseeing management’s activities and ensuring thatevaluating whether management’s plans are balanced from a risk/reward perspective. The Board and its committees perform this oversight through a variety of mechanisms.

31 2021 PROXY STATEMENTCONAGRA BRANDS 32

Board-Level Discussions

Each fiscal year, the Board reviews and discusses our strategic plan and the longer-term risks and opportunities we face. The Board routinely receives reports from significant business units and functions, and these presentations include a discussion of the business, regulatory, compliance, operational, and other risks associated with planned strategies and tactics. The Board also receives regular reports regarding the activities of management’s Enterprise Risk Management Committee, which focuses on assessing and monitoring enterprise-wide risk.risk, including cybersecurity and information technology risks.

Without the right talent, we cannot implement the strategies we devise. Oversight of the company’s approach to and investment in human capital management and talent development are thus key governance matters for the Board. Directly, and through its HR Committee, the Board engages regularly with management on human capital matters. Specific HR Committee activities are supplemented by full Board actions. For example, the full Board receives an annual succession planning presentation from management during which potential successors to senior leadership roles are discussed, arranges opportunities to engage directly with emerging talent in the organization, and discusses the evolution of Conagra’s culture in the context of the CEO’s annual goals and objectives.

During fiscal 2021, the full Board also spent time at each of its regularly scheduled meetings discussing risks associated with the COVID-19 pandemic. Among the topics discussed were:

|

|

|

|

|

|

Audit / Finance Committee Oversight

The Audit / Finance Committee’s charter requires it to review our processes for identifyingreports from management and managingdiscussing policies with respect to significant enterprise-wide risks facing the company, including, but not limited to financial risks (suchsuch as derivative and treasury risks),risks and associated regulatory requirements, cybersecurity and information technology risks (including review of the state of the company’s cybersecurity, emerging cybersecurity developments and threats, and the company’s strategy to mitigate cybersecurity risks), and operational risks, and to oversee ourhow such risks are being identified, assessed and managed by the company and management. At least annually, the Audit / Finance Committee reviews and recommends for approval of the full Board the membership of the company’s Enterprise Risk Management Committee. In addition, the Audit / Finance Committee is responsible for overseeing risks related to the company’s financial condition (including matters such as liquidity, margin management, debt levels, credit ratings and interest rate risk exposure), capital structure including borrowing, liquidity,(including sources and allocationuses of capital.capital), and long-term financing strategy. The Audit / Finance Committee also oversees our management of financial risks by, among other things, reviewing our significant accounting policies and the activities of management’s Enterprise Risk Management Committee, maintaining oversight of our Internal Audit function, holding regular executive sessions with our Chief Financial Officer and Controller, our head of Internal Audit, and our independent auditors, and receiving regular legal and regulatory updates from legal counsel. Our management provides an enterprise risk management report to the Audit / Finance Committee on a semi-annual basis.

The Chair of the Audit / Finance Committee reports to the Board on the Committee’s activities.

Human Resources Committee Oversight

The HR Committee reviews the company’s leadership development activities to ensureshape appropriate succession planning occurs.planning. This includes the establishment of an emergency succession protocol in the event of the CEO’s sudden incapacity or departure.

33 CONAGRA BRANDS2022 PROXY STATEMENT 32

The HR Committee also reviews the relationship between the company’s compensation programs and risk and has adopted a series of policies and practices to reduce risk in our compensation programs. These policies and practices include, but are not limited to, the following:

| Annual Advisory Vote on Named Executive Officer Compensation |

Consistent with our shareholders’ preference, last indicated at the 2017 Annual Meeting of Shareholders, our shareholders are given an opportunity every year to vote, on an advisory basis, to approve our named executive officer compensation. | |||

Stock Ownership Guidelines for Directors and Senior Leaders | Directors and senior leaders across the company are subject to stock ownership guidelines.

All non-employee directors are expected to acquire and hold during their tenure shares of our common stock with a value of at least $500,000.

Each senior leader across the company is subject to stock ownership guidelines equal to a multiple of that person’s salary. Mr. Connolly, our President and CEO, is required to own shares of our common stock having a value of at least six times his salary, and each of our other named executive officers is required to own shares of our common stock having a value of at least three or four times his or her salary. | |||

Anti-Pledging / Hedging Policy | Our directors and executive officers, including our named executive officers, are prohibited from pledging their shares of company stock or hedging their ownership of company stock, including by trading in publicly-traded options, puts, calls, or other derivative instruments related to company stock or debt. Our hedging policy for directors and executive officers does not apply to other employees. | |||

Clawback Policy | We have a clawback policy that requires excess amounts paid to any of our senior officers under our incentive compensation programs to be recovered in the event of a material restatement of our financial statements for fiscal 2013 or later fiscal years, when such restatement results from the fraudulent, dishonest, or reckless actions of the senior officer. | |||